*APR= Annual Percentage Rate. *APY= Annual Percentage Yield.

CENTRAL to your Financial Well-being

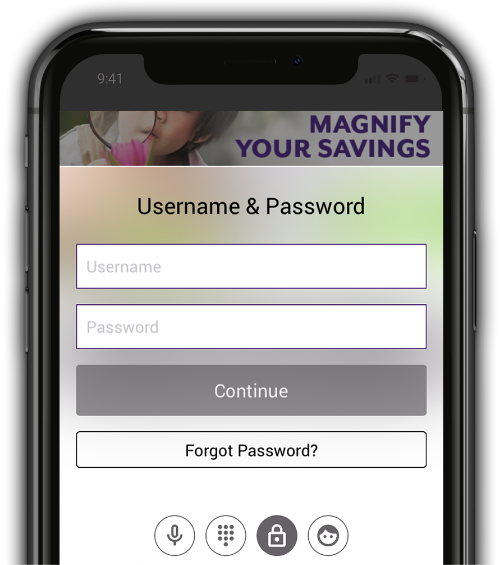

Personal

Understanding the needs of our members and working together to achieve your financial goals.

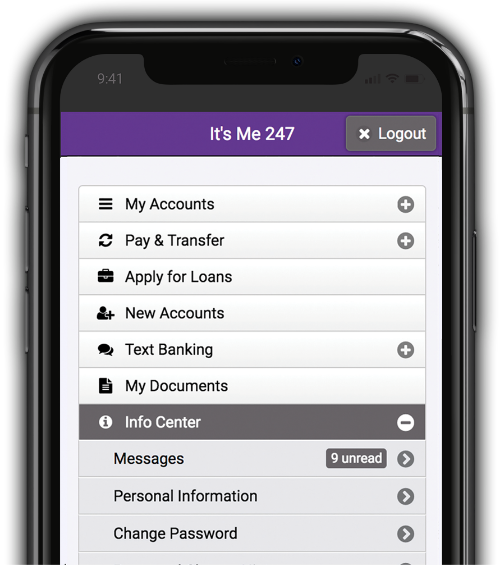

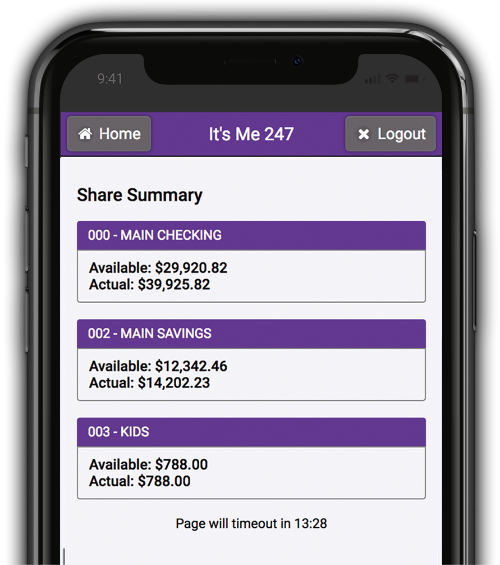

Savings

Your savings starts the moment you join our Hawaii Central ohana. Watch your savings grow.

VISA®

Credit Card

Earn 1% cash back! Cash back earned will automatically be credited to your statement, monthly. For the first six months after opening, receive an additional 4% Cash Back based on the first $7,500 in monthly eligible net purchases.

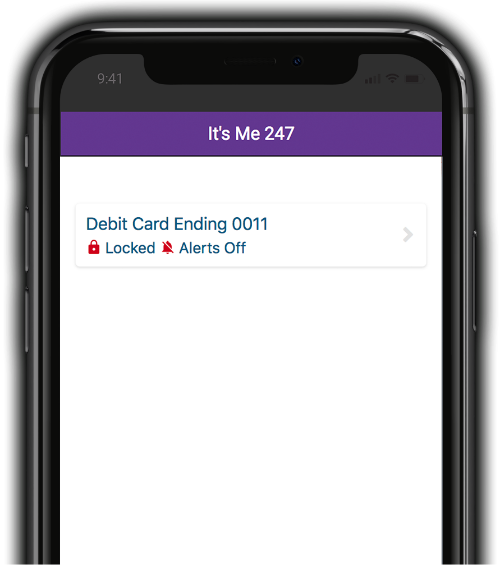

VISA®

Debit Card

Our Visa Debit Card offers members the convenience of a checkbook and ATM card in one. Use it for purchases at merchants displaying the Visa logo and the purchase amount will be withdrawn from your Share Draft Checking Account.