FBI On The Bottom Line

FBI HONOLULU WILL JOIN HAWAII CENTRAL FCU ON THE BOTTOM LINE TO DISCUSS FRAUDS AND SCAMS IN HAWAII

Internet crimes against individuals over the age of 60 have also increased, as this group is by far the most impacted by fraud and scams. According to IC3, the losses resulting from elder fraud in Hawaii have nearly tripled from $10M to $28M in the last three years alone.

FOR IMMEDIATE RELEASE

December 6, 2024

Contact:

Amber Milsap

Community Relations Officer

(808) 441-7364

amber@hawaiicentral.org

www.hawaiicentral.org

FBI HONOLULU WILL JOIN HAWAII CENTRAL FCU ON THE BOTTOM LINE TO DISCUSS FRAUDS AND SCAMS IN HAWAII

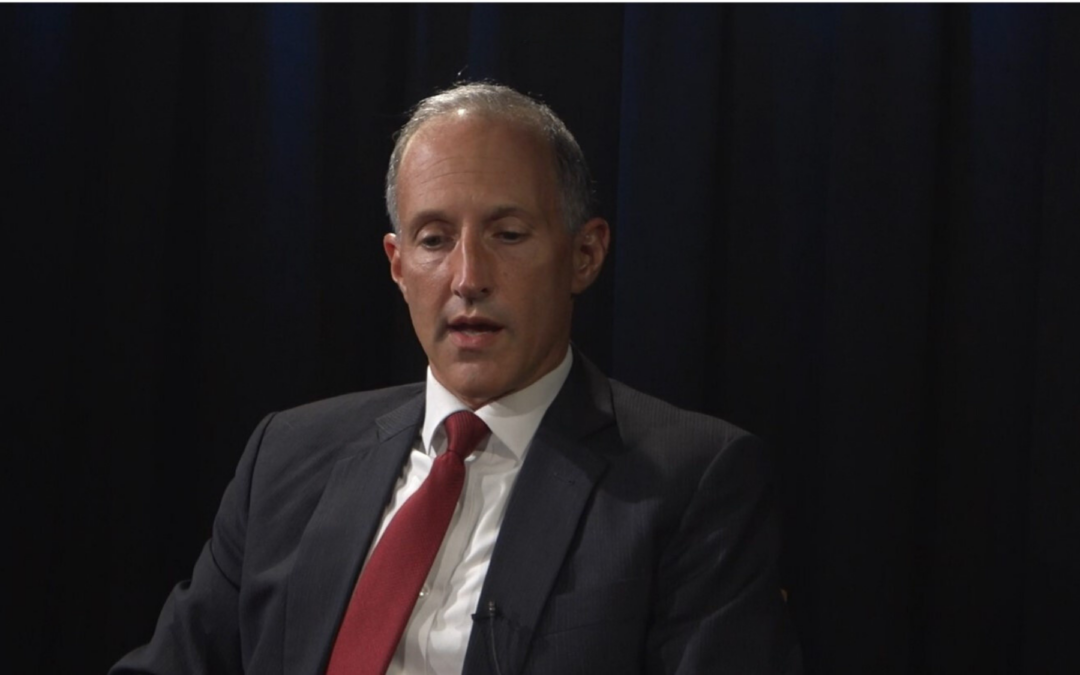

HONOLULU, HI—FBI Honolulu Special Agent in Charge (SAC) Steven Merrill will join Hawaii Central Federal Credit Union as the first guest on The Bottom Line, the credit union’s new episode series aimed at tackling the issues that impact their members and the community they serve. Starting January 15, 2025, the series is set to air on Spectrum Channel 53, the 3rd Wednesday of every month at 6:00 pm. Episodes will also air the following Sunday at 10:30 am.

SAC Merrill will help kick things off on January 15, with an episode focused on elder fraud, including the various scams used to defraud our Kupuna and how to avoid victimization. He will return as a guest in February to provide further insight into cryptocurrency investment scams.

According to the FBI Internet Crime Complaint Center, (IC3), the state of Hawaii saw $31.8M in losses resulting from cryptocurrency investment scams in 2023. This figure nearly doubled from $16.5M in 2022.

Internet crimes against individuals over the age of 60 have also increased, as this group is by far the most impacted by fraud and scams. According to IC3, the losses resulting from elder fraud in Hawaii have nearly tripled from $10M to $28M in the last three years alone.

“If an investment sounds too good to be true, it probably is too good to be true,” Merrill warns. “A stranger should never be directing you where to go on your computer, and you should be wary of any stranger who contacts you regarding financial matters.”

If you or someone you know is a victim of a fraud or scam, contact FBI Honolulu at:

• FBI Honolulu Complaint/Tip Line: (808) 566-4300/tips.fbi.gov

• Internet Crime Complaint Center: ic3.gov

For more information on cryptocurrency scams, visit: https://www.fbi.gov/how-we-can-help-you/victim-services/national-crimes-and-victim-resources/cryptocurrency-investment-fraud

The FBI Honolulu’s area of responsibility includes Hawaii, Guam, Saipan and American Samoa.

About Hawaii Central Federal Credit Union

Hawaii Central Federal Credit Union is recognized by FORBES as a top Credit Union in the State of Hawaii. Founded in 1937, Hawaii Central Federal Credit Union is a member-owned, not-for-profit financial institution serving over 16,000 members and has nearly $300 million in assets. Membership is open to all individuals who live, work, worship or attend school on Oahu. Businesses and other legal entities on the island are also eligible for membership.